Hi Everyone! I hope everyone is fine and doing well. Today we are here with the Uttar Bihar Gramin Bank post. In this post, we will cover different types of loan interest rates. The bank offers various types of loans to its customers, and rates vary with type and time. We will be providing the latest rates, which will definitely help. So, stay connected with us till the end of this Uttar Bihar Gramin Bank Loan Interest Rates post to know in detail.

Uttar Bihar Gramin Bank Loan Interest Rates 2024

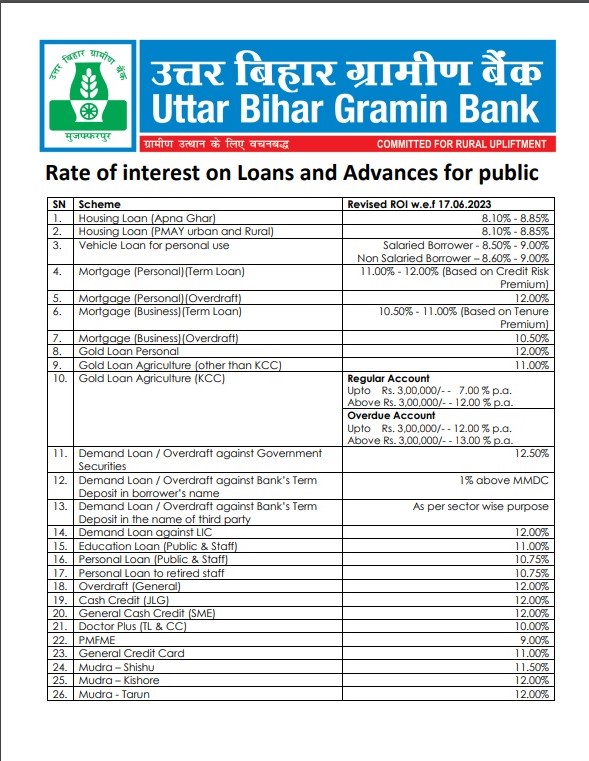

Rate of interest on Loans and advances for public

- Housing Loan (Apna Ghar) 8.10% – 8.85%

- Housing Loan (PMAY urban and Rural) 8.10% – 8.85%

- Vehicle Loan for personal use Salaried Borrower – 8.50% – 9.00%

Non Salaried Borrower – 8.60% – 9.00% - Mortgage (Personal)(Term Loan) 11.00% – 12.00% (Based on Credit Risk

Premium) - Mortgage (Personal)(Overdraft) 12.00%

- Mortgage (Business)(Term Loan) 10.50% – 11.00% (Based on Tenure

Premium) - Mortgage (Business)(Overdraft) 10.50%

- Gold Loan Personal 12.00%

- Gold Loan Agriculture (other than KCC) 11.00%

- Gold Loan Agriculture (KCC) Regular Account

Upto Rs. 3,00,000/- – 7.00 % p.a.

Above Rs. 3,00,000/- – 12.00 % p.a.

Overdue Account

Upto Rs. 3,00,000/- – 12.00 % p.a.

Above Rs. 3,00,000/- – 13.00 % p.a. - Demand Loan / Overdraft against Government

Securities

12.50% - Demand Loan / Overdraft against Bank’s Term

Deposit in borrower’s name

1% above MMDC - Demand Loan / Overdraft against Bank’s Term

Deposit in the name of third party

As per sector wise purpose - Demand Loan against LIC 12.00%

- Education Loan (Public & Staff) 11.00%

- Personal Loan (Public & Staff) 10.75%

- Personal Loan to retired staff 10.75%

- Overdraft (General) 12.00%

- Cash Credit (JLG) 12.00%

- General Cash Credit (SME) 12.00%

- Doctor Plus (TL & CC) 10.00%

- PMFME 9.00%

- General Credit Card 11.00%

- Mudra – Shishu 11.50%

- Mudra – Kishore 12.00%

- Mudra – Tarun 12.00%

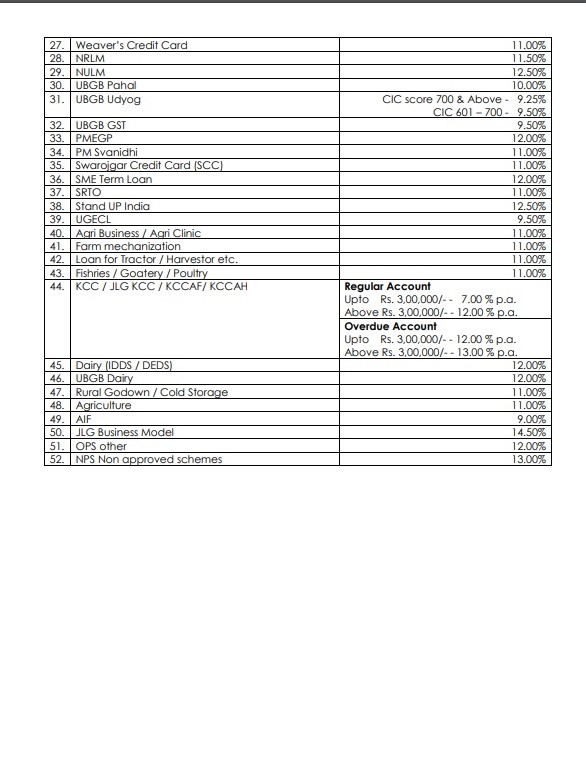

26. Weaver’s Credit Card 11.00%

- NRLM 11.50%

- NULM 12.50%

- UBGB Pahal 10.00%

- UBGB Udyog CIC score 700 & Above – 9.25%

CIC 601 – 700 – 9.50% - UBGB GST 9.50%

- PMEGP 12.00%

- PM Svanidhi 11.00%

- Swarojgar Credit Card (SCC) 11.00%

- SME Term Loan 12.00%

- SRTO 11.00%

- Stand UP India 12.50%

- UGECL 9.50%

- Agri Business / Agri Clinic 11.00%

- Farm mechanization 11.00%

- Loan for Tractor / Harvestor etc. 11.00%

- Fishries / Goatery / Poultry 11.00%

- KCC / JLG KCC / KCCAF/ KCCAH Regular Account

Upto Rs. 3,00,000/- – 7.00 % p.a.

Above Rs. 3,00,000/- – 12.00 % p.a.

Overdue Account

Upto Rs. 3,00,000/- – 12.00 % p.a.

Above Rs. 3,00,000/- – 13.00 % p.a. - Dairy (IDDS / DEDS) 12.00%

- UBGB Dairy 12.00%

- Rural Godown / Cold Storage 11.00%

- Agriculture 11.00%

- AIF 9.00%

- JLG Business Model 14.50%

- OPS other 12.00%

- NPS Non approved schemes 13.00%

Scheme Revised ROI w.e.f 17.06.2023

The rates given above are the latest ones that will be applicable if opted for by anyone. There may be slight differences with the above one.

Official Link: DBGB

Documents Required for the Uttar Bihar Gramin Bank Loan

Since banks provide various types of loans, the documents vary for different loans. In order to get detailed and exact documentation information, please contact your home branch.

So, this is all about Uttar Bihar Gramin Bank Loan Interest Rates it.

Contact: DBGB

Keep visiting PBGBBank

Thank You!

- Uber Account Deletion - October 27, 2024

- Add Favourite Locations in Uber App - October 27, 2024

- Update Uber Registered Email ID - October 26, 2024