Hi Everyone! Bank of Baroda allows customers to open a Public Providen Fund (PPF) account online. You can apply for it online through its official website. We will be discussing all the details, from documentation to the application process. So, stay with us till the end of this Open PPF Account Online in Bank of Baroda post to know in detail.

Check Bank of Baroda Account Balance on Whatsapp

Benefits

No income tax on interest income

Nomination facilities are available.

Account extension facility

Tax rebate under Sec 80c

Documents Required

The given documents are accepted as valid documents for the purpose of identification and address proof:

1. Passport

2. Driving Licence

3. Voter’s ID Card

4. PAN Card

5. Job card issued by NREGA signed by the State Government officer

6. Letter issued by the National Population Register

In case of minors, below documents are required:

1. Proof of date of birth

2. Details of the guardian along with KYC documents

The submission of PAN and Aadhaar is mandatory.

Apply Bank of Baroda PMJDY Account

How to Apply for PPF Account in BOB?

So, follow the below steps:

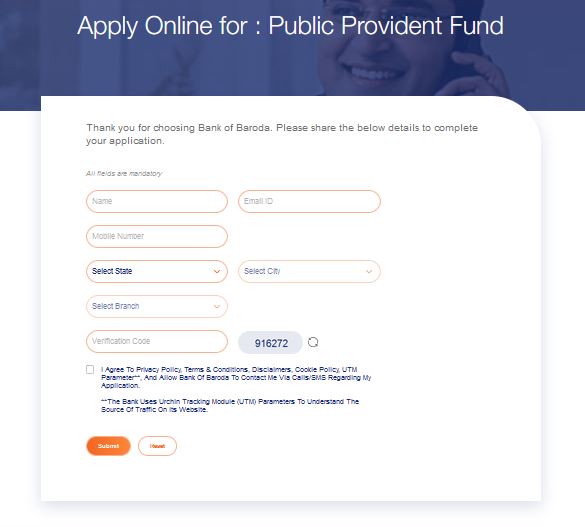

- First of all, click on the below Apply Now link.

- A small form will open.

- Fill in all the details, such as name, email ID, mobile number, state, city, and branch, and then click on Submit.

- Your record will be saved, and then an executive will contact you for further processing of the account.

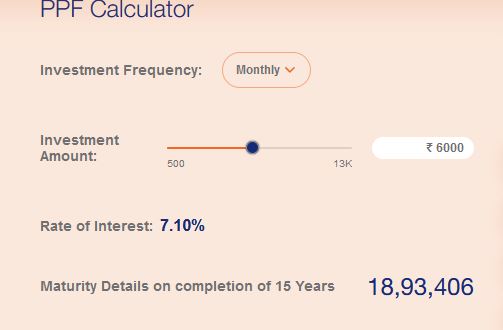

PPF Calculator

Apply for SSA in Bank of Baroda

What is the minimum amount to be contributed every year?

Rs 500

What is the maximum that can be contributed in a financial year?

Rs 1.5 Lakh

Can NRIs open PPF accounts?

No

Can I open a joint PPF account?

A joint PPF account is not allow.

What if the minimum deposit is not made?

Account will be treat as a discontinue account, and a penalty of Rs 50 will be fine for each default year.

What is the maturity period?

15 years. After 15 years, it can be extend for a further period of 5 years for an unlimited number of times.

What is the interest rate?

The interest rate is decide by the government of India from time to time. Normally, it varies from 7 to 8.5%.

Can I transfer my PPF account?

Yes, it can be transfer from a branch to post office and vice versa. Also from one branch to another. But it cannot be transferr from one person to another.

Can I withdraw before maturity?

Yes after the 5th year. Maximum of 50% of the deposited amount after 4th year.

Toll Free Number: 18005700

So, this is all about Open PPF Account Online in Bank of Baroda it.

Thanks.

- Uber Account Deletion - October 27, 2024

- Add Favourite Locations in Uber App - October 27, 2024

- Update Uber Registered Email ID - October 26, 2024