As in other banks and post offices, the Bank of Baroda also allows for the opening of Sukanya Samriddhi accounts. It is one of the best investment schemes for girls. We will be discussing all the details, from documentation to the application process. So, stay connected with this Apply for SSA in Bank of Baroda post till the end to know the details.

Apply Bank of Baroda PMJDY Account

What is the Sukanya Samriddhi Account (SSA)?

Devised for the welfare of the girl child through the provision of finances at the time of important events in her life, i.e., education and marriage. The Sukanya Samriddhi Yojana scheme was launched on February 12, 2014, as part of the Beti Bachao Beti Padhao campaign. The Sukanya Samriddhi Account offers a competitive rate of interest of 8.0% along with tax benefits.

Benefits

Open with just Rs 250

Double tax benefits

Attractive rate of interest

Premature withdrawal is allowed.

Deposit to be made for 15 years

Documents Required

Legal guardians or parents of the beneficiary can make the deposit until the beneficiary turns 18.

- Filled up Sukanya Samriddhi Registration Form

- Birth certificate of the girl child

- ID proof of the depositor

- Residential proof of the depositor

- Stamp-sized photos

Check Bank of Baroda Account Balance on Whatsapp

How to Apply for SSA in Bank of Baroda Online?

So, follow the below steps:

- First of all, click on the below Apply Now link.

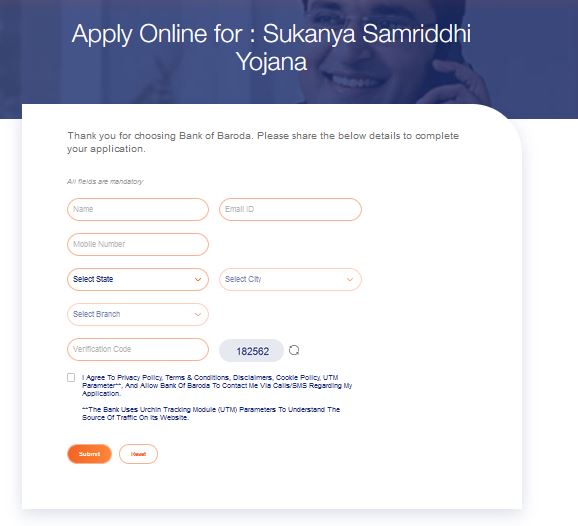

- A small form will open after clicking on the above.

- Fill in all the details, such as name, email ID, mobile number, state, city, and branch, and then click on Submit.

- Your record will be save, and then an executive will contact you for further processing.

Open PPF Account Online in Bank of Baroda

Who can open the account?

A parent of a girl child on behalf of the beneficiary can open the account any time after the birth of the girl child until she turns ten.

Who can make the deposit?

Legal guardians or parents of the beneficiary can make the deposit until girl turns 18.

When can the beneficiary operate account?

When she turns 18, she can operate.

How much of a minimum contribution is to be made each year?

Minimum of Rs 250 deposit in a financial year.

What happens if the account is not maintain?

If a deposit is not made every year, the account goes into default. It can be regularise by paying a small fine of Rs 50 for each year of default along with the minimum annual deposit in respect of the defaulted years.

How to receive an amount after maturity?

Once the account gets mature, the beneficiary can collect by submitting the following documents:

- SSA withdrawal application

- Proof of identity

- Proof of residence and citizenship

- Proof of age

Can I transfer an account?

Yes, you can transfer an account to any branch or Post Office within India once the beneficiary provides proof of change of residence.

Source: BOB SSA

Toll Free Number: 18005700

So, this is all about Apply for SSA in Bank of Baroda it.

Comment below if you have any queries.

Thanks for reading.

- Uber Account Deletion - October 27, 2024

- Add Favourite Locations in Uber App - October 27, 2024

- Update Uber Registered Email ID - October 26, 2024